Diageo Considers RCB Stake Sale

Diageo's early discussions on a $2B RCB deal hint at major shifts in IPL ownership soon!!!

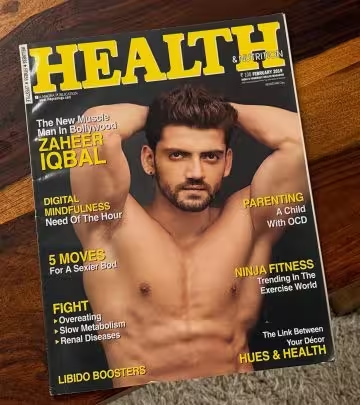

Image: Instagram

In a developing story that could reshape the landscape of Indian Premier League ownership, Bloomberg has reported that British conglomerate Diageo Plc is considering selling part or all of its stake in the IPL champions Royal Challengers Bengaluru (RCB). Diageo, which controls the team through its Indian subsidiary United Spirits Ltd, is said to be exploring a deal that could be valued at up to $2 billion. With talks still in the early stages and no final decision reached, the potential transaction is sparking considerable interest among industry watchers and IPL enthusiasts alike.

Diageo’s Strategic Move

Market observers note that this potential sale comes at a time when corporate ownership in sports teams has increasingly garnered attention. Diageo’s move – if confirmed – would mark a significant shift, transferring a part of its longstanding investment in RCB to new stakeholders. The deal, valued at up to $2 billion (approximately ₹17,000 crore), is still in its nascent discussion stage, leaving much to speculation and anticipation about the future of RCB’s corporate structure.

For now, industry insiders emphasize that the discussions are preliminary. A representative for Diageo has not offered any additional comments beyond confirming that talks are in the early phases. With the current terms still under negotiation, the transaction remains subject to various regulatory and strategic reviews, reflective of the complex nature of sports franchise ownership deals.

Market Reaction And Implications

The news has triggered a flurry of commentary on social media, with hashtags such as #royalchallengersbengaluru, #dl, and #bk echoing across digital platforms. Notably, an Instagram post by Instant Bollywood, a recognized voice in celebrity and trending news circles, referenced the developing story. While the post did not offer further details, it contributed to the growing buzz surrounding the potential sale.

The proposed deal is significant not only in monetary terms but also as a strategic recalibration for Diageo. The British firm has long been a dominant player in the beverage industry, and its involvement in sports has historically served as a platform to merge brand value with fan engagement. By potentially divesting its RCB stake, Diageo could be repositioning its portfolio, while also inviting fresh investment and new strategic partnerships into one of IPL’s most celebrated franchises.

Sports business experts point out that such moves are not unusual in the current market environment. With the IPL evolving into a multi-billion-dollar enterprise, investors and managers increasingly see sports franchises as dynamic assets. For RCB – a team with a passionate fan base and high-profile players – the ownership change could bring more than just new capital; it might also infuse fresh ideas into management and marketing strategies.

Future Of Rcb Ownership

The potential sale has raised questions about the future direction of RCB. While many fans celebrate the high-octane on-field performances of their team, the possibility of a major change in ownership structure also carries implications off the pitch. The team’s overall brand, sponsorship deals, and long-term planning could be influenced by the new stakeholders if the deal goes through.

Analysts suggest that should the transaction be finalized, it might herald a trend that sees traditional corporate giants recalibrating their investments in sports, in favor of more diversified or strategically aligned holdings. This process is already underway in several global markets, and the IPL, with its high visibility and lucrative market potential, is no exception.

It is important to note that the talks are still in the exploratory phase. No official statements have confirmed that a deal is imminent. This keeps the door open for further negotiations, likely influenced by market conditions, investor sentiment, and regulatory considerations in India. The eventual outcome will be closely monitored by both business analysts and the IPL’s ardent supporters.

As discussions continue, the potential transaction places RCB at the center of a debate not only about the future of sports investments but also about how traditional brands balance legacy investments with evolving market realities. For Diageo, the implications of such a sale could extend well beyond the immediate financial parameters, affecting the company’s strategic outreach in both the beverage and sports industries.

While the full ramifications remain to be seen, the news has undeniably added another chapter to the ongoing narrative of the IPL’s dynamic evolution. Fans, investors, and corporate strategists alike will be watching the coming weeks with keen interest as more details emerge about this potential deal.

With early-stage talks and speculation in the air, the unfolding story underscores a pivotal moment for both Diageo and RCB. The coming months will be key in determining whether this potential shift can pave the way for renewed growth, fresh investment opportunities, and innovative management in one of cricket’s most admired franchises.

Read full bio of Glendon Moss